What is Customer Experience Worth?

The primary objective of this study was to evaluate the predicted impact of investing in programs designed to enhance customer experience (CX) by establishing a comprehensive baseline of current CX performance. By assessing present CX levels, the study identified key pain points, satisfaction drivers, and potential areas for improvement. These insights informed the formulation of targeted CX investments and strategies, with an emphasis on optimizing the customer journey and driving measurable outcomes such as increased satisfaction, loyalty, and business growth.

In an increasingly competitive consumer packaged goods (CPG) landscape, it was essential for the company to give customers every reason to remain loyal, continue doing business, and even expand their use of the organization’s products. Enhanced customer experiences were no longer just a differentiator—they had become a necessity to stave off the effects of expanded competition from established CPG brands and new market entrants.

Demographic Summary

The sampling framework consisted of all customers who had purchased the company’s products within the past six months. This timeframe ensured that feedback reflected recent experiences and interactions with the brand. Customers who had not opted in to participate in consumer and marketing research were excluded to comply with privacy preferences and data usage regulations.

6.7K

From the eligible pool, participants were randomly selected to minimize selection bias and maximize the utility of the study's findings.

99%

The sample size was calculated to achieve high confidence with a minimal margin of error, ensuring high reliability and precision.

29 + 17

Twenty-nine global markets localized through back translations to seventeen primary market languages to increase accessibility and response rates.

5

Product, Customer Service, Company Brand, Salesperson, and Digital experience areas measured.

26

Questions covering product innovation and value, customer service during orders and returns, company mission and core values, salesperson relationship, and online sign-up, search, and checkout process, among others.**

3

Weeks in field with initial invitation via email followed by two reminder messages.

Study Parameters*

Findings

Overall Experiences

The satisfaction findings provide an overview of customer perceptions across the key experience areas, based on responses to a standardized five-point scale (very satisfied to very dissatisfied). The results are presented as Top 2 Box percentages, representing the proportion of participants who selected either satisfied or very satisfied. This approach captures the strongest levels of satisfaction across the surveyed dimensions and offers insights into general satisfaction across all customer experience areas.

Spend

Higher satisfaction ratings accompanied greater spend values: that is, highly satisfied customers spend more, on average, than those with lower satisfaction levels. Notice the different impact: the satisfaction that consumer segment 1 reported with the overall company experience was less influential to spend than it was for consumer segment 2.

This highlights the need to not only understand and manage general experiences but also the specific experiences of individuals and groups.

Impact***

Increases in satisfaction with the company as a whole (e.g., reputation, mission, values) offered the highest predicted return-on-investment (ROI). In a three-month period, how much increase in incremental revenue would that bring?

$1.44M

(US dollars)

Product Experiences

These findings provide a clear snapshot of how customers perceive various company experiences, measured on a standardized five-point scale from very satisfied to very dissatisfied. We focus on Top 2 Box percentages – the proportion of respondents who reported being satisfied or very satisfied – to spotlight the highest levels of contentment. This approach offers a detailed view of overall satisfaction trends specifically tied to the company experience.

Spend

Customers who reported higher satisfaction spent more on average than those with lower satisfaction levels. This effect varies between segments: for consumer segment 1, satisfaction with the value of the product had a greater influence on spending than for consumer segment 2. For other satisfaction areas (e.g., product innovation), similar influence on spend was observed.

Impact***

Boosting product satisfaction – durability, quality, design, packaging, and innovation – yielded the highest predicted ROI. Over a three-month period, what level of incremental revenue growth might these enhancements generate?

$5.07M

(US dollars)

Company Experiences

The satisfaction findings provide an overview of customer perceptions across the key experience areas, based on responses to a standardized five-point scale (very satisfied to very dissatisfied). The results are presented as Top 2 Box percentages, representing the proportion of participants who selected either satisfied or very satisfied. This approach captures the strongest levels of satisfaction across the surveyed dimensions and offers insights into general satisfaction across all customer experience areas.

Spend

Customers with higher satisfaction tend to spend more overall, indicating a direct link between contentment and increased expenditure. Notably, consumer segment 1 shows a stronger correlation between satisfaction with the media and endorsement aspects and spending, compared to segment 2.

Unlike other areas, the disparity in perceptions and the impact of those perceptions on spend is quite noticeable in several categories. Experience management is not a "one-size fits all" endeavor.

Impact***

Increases in satisfaction with the company's approaches to social responsibilty and community efforts, the public reputation it enjoys, and the quality of brand awareness and strengthening materials offered the highest predicted return-on-investment (ROI). Over a three-month period, what level of additional revenue could be anticipated?

$4.32M

(US dollars)

Customer Care Experiences

Our results capture how customers view various aspects of customer care on a five-point scale ranging from very dissatisfied to very satisfied. We highlight the Top 2 Box percentages – the share of respondents who rate their experience as either satisfied or very satisfied – to emphasize the highest levels of customer contentment. This approach delivers a nuanced understanding of overall satisfaction trends specifically related to customer care.

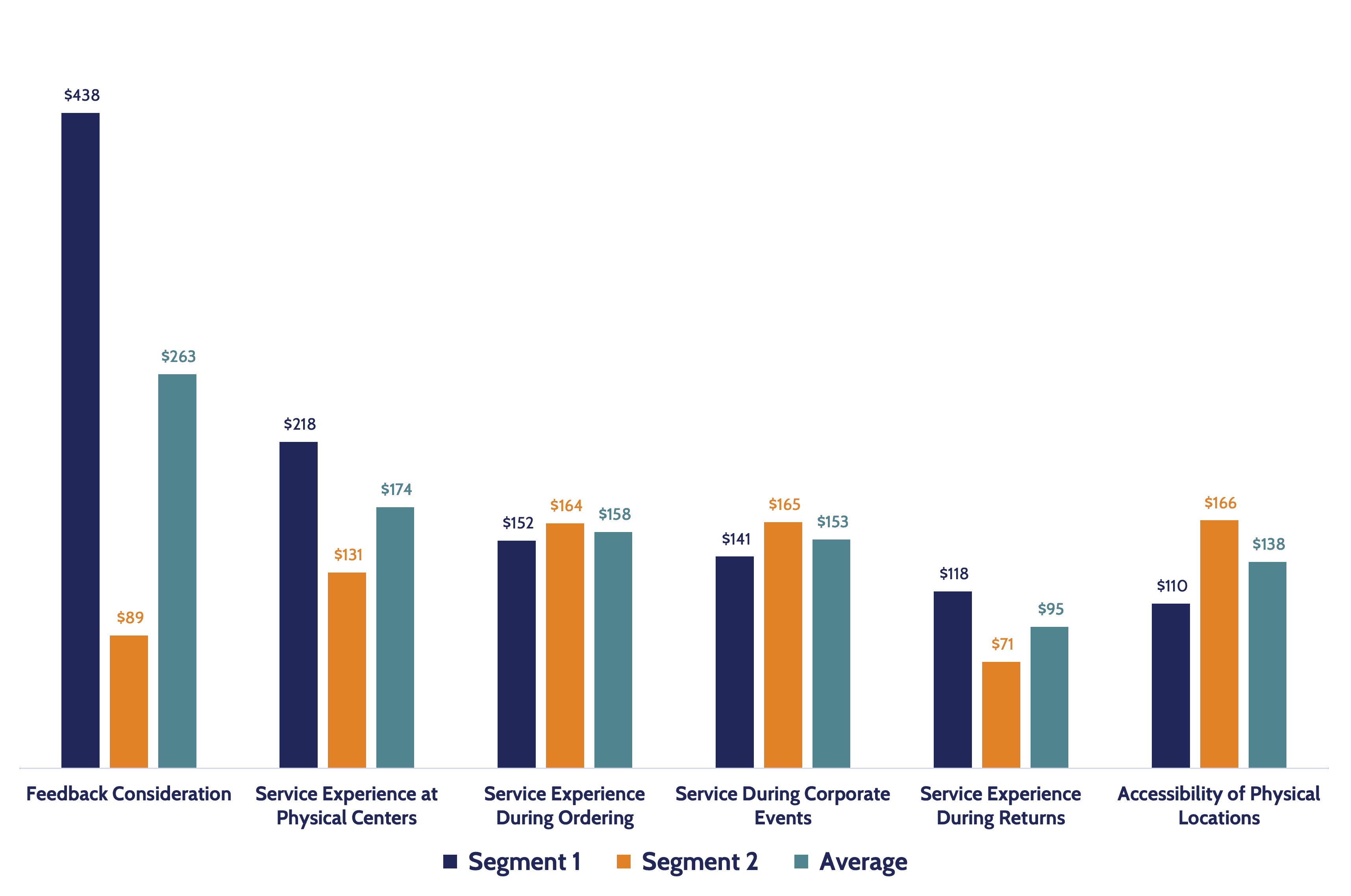

Spend

Customer care is experienced quite differently for the consumer segments. With the exception of customer care during ordering, every other element of customer care is of far greater consequence to segment 1 than for segment 2. Notice the influence that feedback consideration holds for segment 1: night-and-day difference! Perceiving that the company receives and takes actions on feedback is a distinguishing feature of segment 1's experience.

Impact***

Greater effort to seek, receive, and lend consideration to customers' feedback as well as ensuring accessibility of physical have sizable impacts on predicted revenue. Upon doing so and across a three-month span of time, what is the anticipated incremental revenue increase?

$1.55M

(US dollars)

Salesperson Experiences

These satisfaction findings outline customer perceptions of key salesperson experience areas, measured on a standardized five-point scale from very satisfied to very dissatisfied. We emphasize Top 2 Box percentages, which represent the share of respondents rating their experience as either satisfied or very satisfied. This method highlights the highest satisfaction levels within the surveyed dimensions, offering clear insights into the strengths of the salesperson experience.

Spend

Customers who report higher satisfaction consistently exhibit increased spending, underscoring a direct connection between positive experiences and higher expenditures. Notably, consumer segment 1 shows a markedly stronger link between salesperson relationship quality and overall spending than did segment 2.

In another category, the variation in customer perceptions and its impact on spending is particularly pronounced for the support consumer groups receive in ordering products. This illustrates that some customers rely on salespeople to a greater extent than others in their purchasing decisions.

Impact***

Notwithstanding the positive ROI for salespeople experience, the inconsistency of spend increases does not provide strong enough evidence that improvements in this area will result in greater spends. This only means that as one of many aspects of the purchase experience, other aspects (e.g., product, company, customer care) play a stronger role in reliably predicting spend.

Digital Experiences

Our results capture how customers perceive various aspects of the digital experience on a five-point scale, ranging from very satisfied to very dissatisfied. We highlight the Top 2 Box percentages (i.e., the share of respondents who rate their experience as either satisfied or very satisfied) to emphasize the highest levels of digital satisfaction. This approach provides a detailed understanding of overall satisfaction trends specifically related to digital interactions.

Spend

The digital experience varies significantly across consumer segments. The sign-up experience and the checkout process online is a stronger predictor spend for Segment 1 than for Segment 2, suggesting perhaps that Segment 2 has other options to facilitate spend than the website.

Impact***

Despite the positive ROI of digital experience improvements, the inconsistency in spend increase does not provide strong enough evidence that enhancements in this area will be linked with higher spend. This suggests that, as one of many factors in the overall purchase journey, other elements (e.g., product, company, customer support) play a more significant role in reliably predicting spend.

Recommendations

The primary objective of the study was to evaluate the predicted impact of investing in programs that enhanced customer experience (CX) by establishing a comprehensive baseline of existing CX performance. By assessing current CX levels, the study identified key pain points, satisfaction drivers, and potential areas for improvement. These insights guided the formulation of targeted CX investments and strategies, with a focus on optimizing the customer journey and driving measurable outcomes such as increased satisfaction, loyalty, and business growth.

In an increasingly competitive consumer packaged goods (CPG) landscape, the company recognized the necessity of providing customers with every reason to remain loyal, continue doing business, and even expand their use of its products. Enhanced customer experiences were not merely a differentiator – they had become essential for countering the challenges posed by established CPG brands and emerging market entrants. This is most evident in the varying needs of the consumer segments.

Note: These recommendations are presented strictly in the context of this study’s aim: to pinpoint areas of customer experience that positively influence three-month spending. They do not account for legal, regulatory, compliance, jurisdictional, strategic, value stream, technological, or other potential constraints that might affect the organization’s capacity or inclination to act. Consequently, these suggestions should be evaluated in conjunction with other data sources before being put into practice.

Interpretation Guide

To assist in comparing consumer segments with each other and with the global experience, use this interpretation guide.****

Customer experiences marked with solid and striped red and yellow circles are areas of first priority. These are experience areas that are doing comparatively below to average performance but these have average to stronger-than-average links with spend.

Customer experiences marked with hollow red and yellow circles are areas of secondary priority. These are experience areas that are doing comparatively below to average performance but these have weaker-than-average links with spend.

Customer experiences marked with hollow, striped, and solid green circles are areas of strength that should be maintained. These are experience areas that are doing comparatively stronger-than-average performance.

Overall Experience Recommendations

Across the three segments (GL, GL-S1, and GL-S2), Overall Product Experience consistently appears as a strong performer, indicated by green circles that suggest both above-average performance and a solid link to spending. In contrast, Overall Digital Experience displays a red-striped circle in at least one segment, highlighting a top priority for improvement due to its below-average performance but average impact on spend. Meanwhile, Overall Company Experience and Overall Service Experience vary in color across segments, reflecting differences in performance and correlation to spend. These variations underscore the importance of tailoring strategies by segment—focusing on shoring up underperforming areas with high spend impact, while continuing to maintain or enhance strong performers.

Product Experience Recommendations

Across all segments, Product Durability and Quality emerges as a clear strength, indicated by green circles that point to above-average performance and a strong link to spend. In contrast, Value for Price Paid consistently shows red, signaling that it is underperforming yet highly influential on customer spending decisions—making it a top priority for improvement. Meanwhile, other product areas—such as Scientific Basis, Product Effectiveness, Innovation, Sustainability, and Design & Packaging—fall primarily in the yellow range, suggesting they offer moderate performance with room to become key differentiators. Overall, this distribution underscores the need to maintain high-performing areas while prioritizing enhancements that bolster value perceptions and address mid-tier opportunities for growth.

Company Experience Recommendations

Corporate Responsibility and Community Efforts emerged as a consistent strength across all segments, indicating a high level of appreciation for the company’s community engagement. Company Mission and Core Values, along with Media and Endorsements, also demonstrated solid performance, though each segment showed subtle differences in how strongly these factors influenced spending. In contrast, Brand Awareness Materials and Public Reputation fell below or around average performance levels, suggesting a need for more focused improvements. Overall, this distribution highlights that while the company excels in communicating its broader purpose and social commitments, there is room to bolster brand messaging and reputation to achieve a more balanced impact across all segments.

Customer Care Experience Recommendations

Service Experience During Ordering consistently stood out as a strength across all segments, indicating a positive and impactful interaction at the initial purchasing stage. In contrast, Service During Corporate Events emerged as a top priority for improvement, with lower performance and a potentially strong influence on spend. Service Experience During Returns, Feedback Consideration, and the Accessibility of Physical Locations hovered in the moderate range, suggesting they offer meaningful but not fully optimized customer touchpoints. Overall, this distribution emphasizes the need to maintain and reinforce the ordering experience while devoting targeted efforts to enhance event-related services and other mid-tier aspects of customer care.

Salesperson Experience Recommendations

Salesperson Relationship Quality consistently shines as a strong point across all segments, indicating a solid, positive bond between salespeople and customers. Meanwhile, Support for Ordering Products and Product Insights Provided by Salesperson both fall into a moderate range—suggesting that, while these areas aren’t underperforming, they have room for improvement to match the high standard set by relationship quality. By focusing on enhancing ordering support and deepening product knowledge, the company can elevate the overall salesperson experience to even greater heights.

Digital Experience Recommendations

The Checkout Process on the Website shows moderate performance for GL and GL-S2 but emerges as a stronger area for GL-S1, indicating a segment-specific success that could be replicated. Meanwhile, the Sign-Up Experience stands out as a consistent weakness—especially for GL and GL-S1—making it a high priority for improvement. Website Presenceand Search Experience hover around the mid-range, suggesting room for refinement to meet evolving customer expectations. Finally, Digital Tools for Recurring Order Management also appear underutilized or insufficiently optimized, underscoring the need for more seamless, user-friendly features to enhance the overall digital journey.

Conclusions

This study evaluated the predicted impact of investing in programs to enhance customer experience (CX) by establishing a comprehensive baseline of current CX performance. The goal was to identify key pain points, satisfaction drivers, and opportunities for improvement across various CX areas, including product, company, customer care, salesperson, and digital experiences. By surveying 6,685 customers across 29 global markets using a standardized five-point scale, the research captured detailed insights into how customers perceive their interactions with the brand.

The findings revealed that higher satisfaction levels were directly linked to increased customer spending, with noticeable differences between consumer segments. For instance, while certain aspects of the product experience—such as durability and quality—emerged as strong performers with significant ROI potential, areas like value for price paid consistently lagged behind, indicating a top priority for improvement. Similar patterns were observed in company and digital experiences, where aspects like community engagement were strong, yet digital touchpoints such as the sign-up process and checkout needed targeted enhancements.

Based on these insights, the study recommended tailored strategies to optimize the customer journey. For product experiences, the focus should be on maintaining strengths while addressing pricing perceptions. In company experiences, bolstering brand messaging and public reputation is essential. For customer care, reinforcing the strengths of ordering interactions and improving service during events can drive further gains. Salesperson and digital experiences, while moderately performing, require specific enhancements to align better with customer expectations and spending behaviors.

Overall, the study underscores that strategic, targeted investments in CX not only improve satisfaction and loyalty but also drive measurable business growth. In today’s competitive consumer packaged goods landscape, these enhancements are critical for sustaining customer relationships and outperforming market challenges.

* Many individual and organizational characteristics have been (a) anonymized to protect the identity of the client organization, or (b) consolidated to enhance the analytical power needed for subgroup analyses. The analyses, findings, insights, and recommendations are based on actual collected responses (N = 6,685) and reflect the actual data collected.

** Patterns of missingness revealed, on average, individual questions were missing 16.3% of responses (minimum 8.5%, maximum 34.9%). The original sample (N = 10,235) was reduced to respondents with at least 30% of responses to individual questions (i.e., at least 11 of the 33 questions answered) leaving a final sample size of N = 6,685. Imputation methods to mitigate missingness were not performed.

*** Impacts that did not achieve the targeted 99% confidence interval are not highlighted as they are less likely to be replicable.

**** GL = Global (all participants in the study); GL-S1 = Global Segment 1 (all segment 1 participants in the study); GL-S2 = Global Segment 2 (all segment 1 participants in the study)

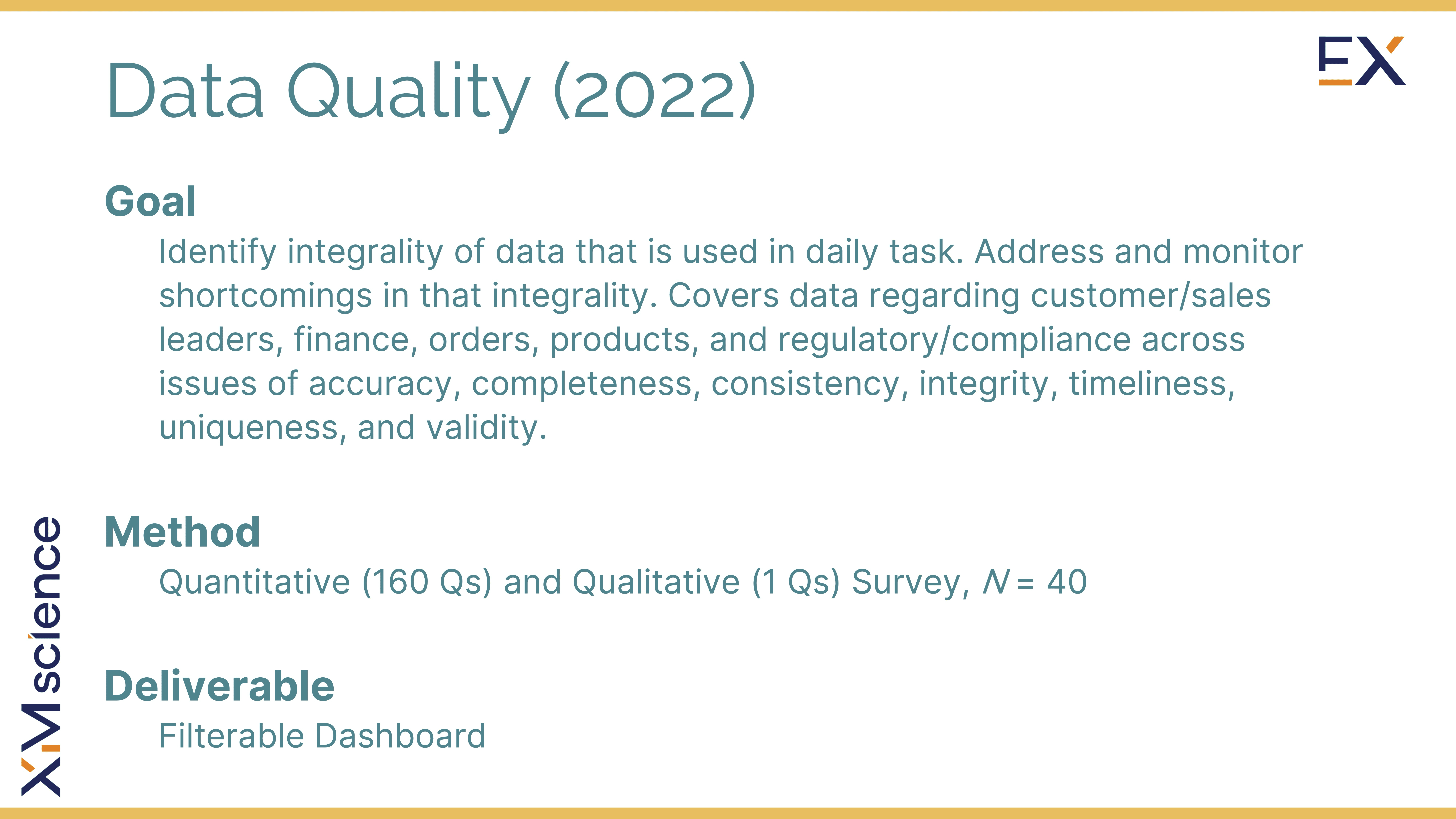

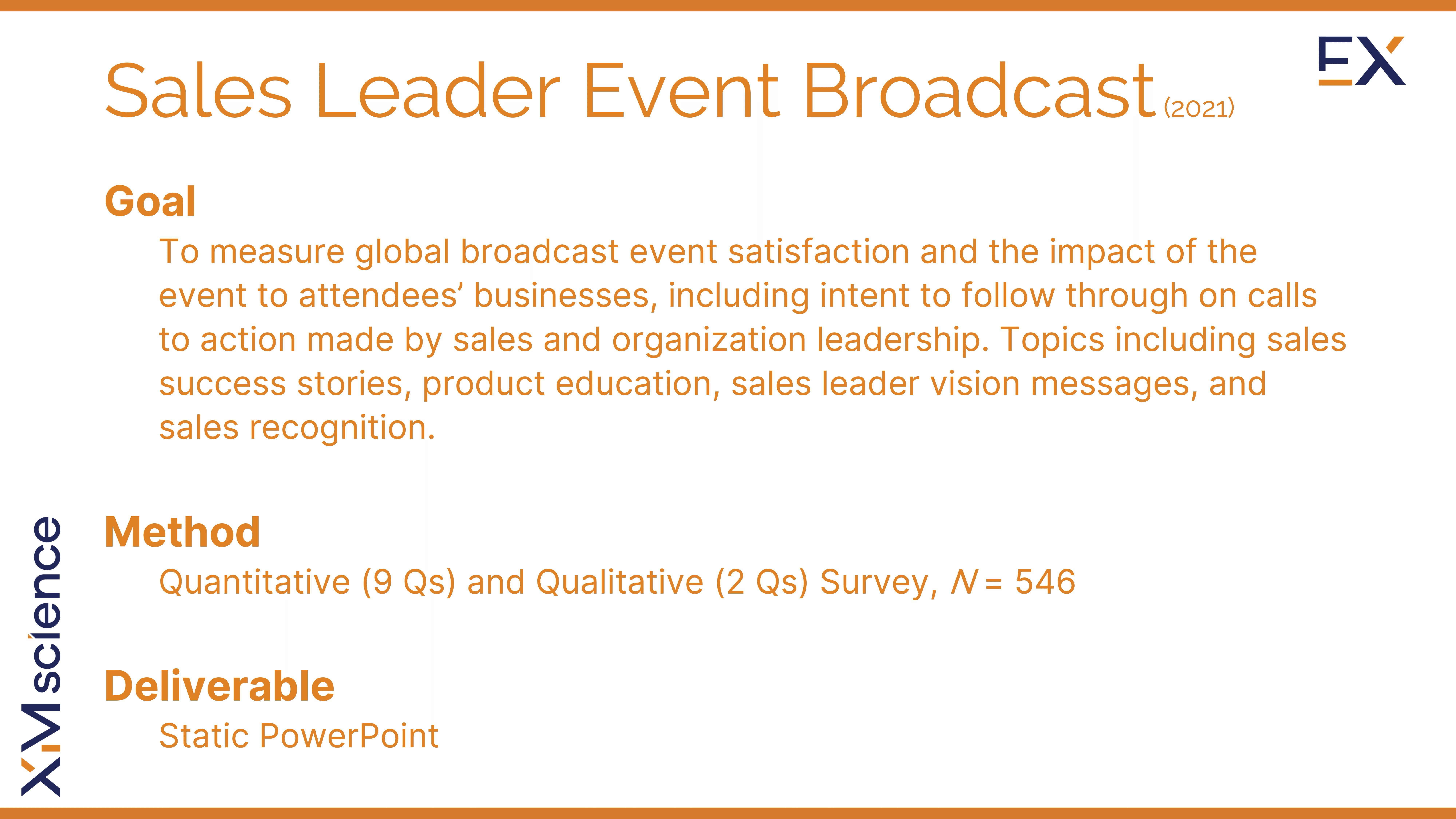

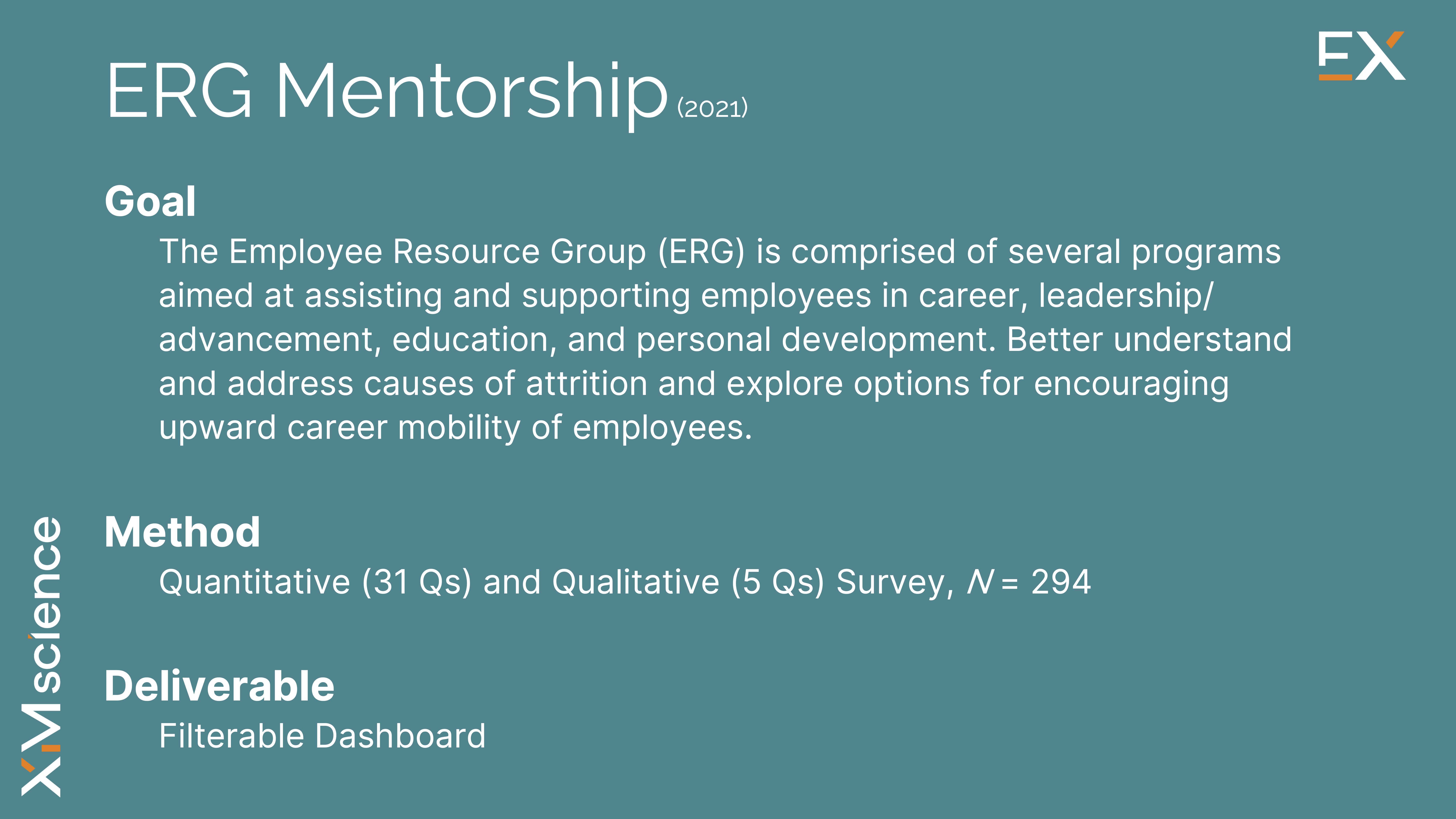

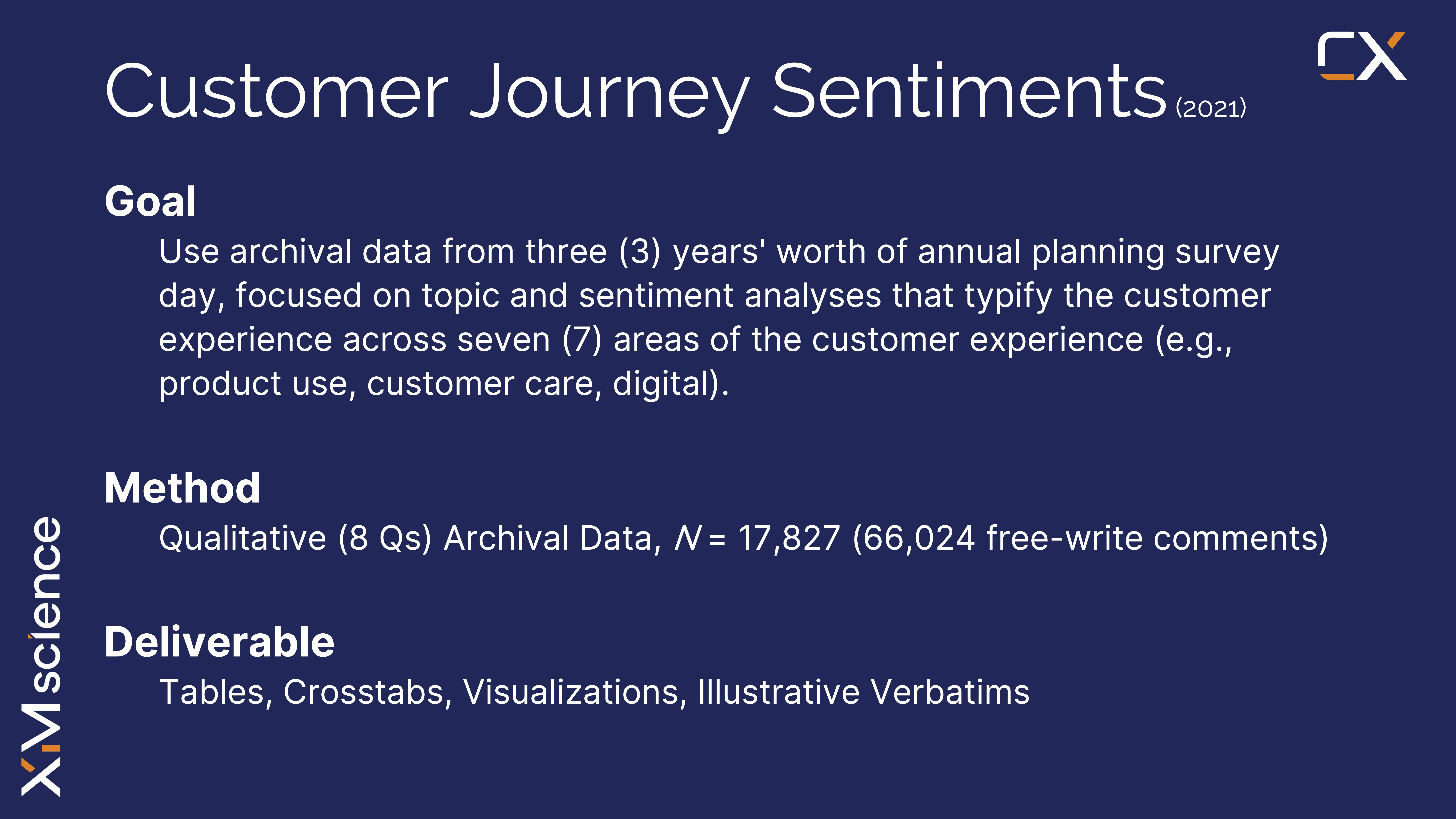

Selected Projects

Unlock the blueprint for unforgettable experiences – the nexus where science meets innovation to elevate customers, employee, product, and brand experiences. Let us guide you in harnessing this power to propel your next breakthrough move for your business.

Solutions

Resources

Connect

mark@xmscience.com

+1 (801) 260-2320

Vineyard, Utah 84059

Subscribe to receive XM insights directly to your inbox and receive a special offer.

© 2025 XMscience. XMscience and all relevant content are protected by copyright and trademark law. All rights reserved.